2 Using Year-End Forms

2.1 Selecting a Formset

At this point, an administrator has successfully imported a

new formset into the Year-End Forms portal. As detailed in Section 1.2.2 above, if you navigate

away from the import screen or close the

Year-End Forms portal, you will be able to access and select the formset you

would like to work with by signing into your GreenshadesOnline.com account, as

detailed in Section 1.1.

From the

GreenshadesOnline.com homepage, you can access your formsets from the Year-End

Forms dashboard and toggle by tax year to see all formset types for the given

year. Clicking on the form type will launch you into the Year-End Forms portal.

An alternative option to

select the formset you would like to work with is by navigating to the

‘Year-End Forms’ tab within the top navigation of GreenshadeOnline.com. This

Year-End Froms management screen allows the administrator, access permitting,

to filter between form types and tax years or view all formsets from all years,

as well as provides details regarding due dates, forms that must still be

issued/distributed to employees, and totals.

2.2 Top Navigation and Settings

After completing the Welcome Wizard, if applicable, it is

recommended that the administrator reviews the Year-End Forms portal specific

setting.

2.2.1 Top Navigation

The main navigation is located at the top of each formset page. This top navigation provides many convenient options that will assist in the basic usage of the Yea-End Forms portal. You can return to the formset homepage at any time by clicking the ‘Year-End Forms’ button on the left side of the navigation bar.

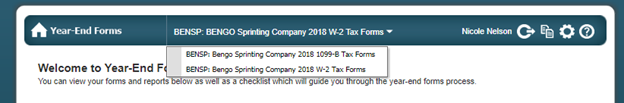

If you have multiple formsets for the same company and tax year, you can use the top navigation to switch between them. Simply click the down-arrow next to the current formset name and a drop-down will appear. Clicking one of the other formset types will navigate you to that specific formset.

The

icons on the right-hand side of the top navigation allow access to the Year-End

Forms specific Settings, Forms, and Help content for the current formset, as

well as a button to securely log/sign out from the Year-End Forms portal.

|

|

HELP: Will take you to the Year-End Forms help content and documentation |

|

|

SETTINGS: Will take to the ‘Settings’ page for the current formset |

|

|

FORMS: Will take you to the ‘View Forms’ page for the current formset |

|

|

LOG OUT: Will sign/log you out of Year-End Forms portal |

2.2.2 Year-End Forms Settings

2.2.2.1

Employee

Access

Only

available for W-2, 1095-C, and T4 formsets

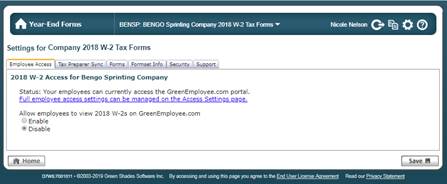

For formset types (W-2s, 1095-Cs, and T4s) that allow employee access to view their tax form(s) electronically, there is an Employee Access setting. By default, the Employee Access setting will be disabled and require the administrator to enable it if they wish.

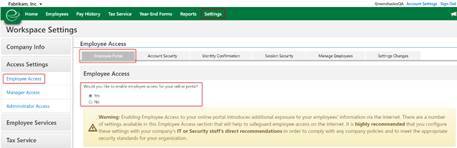

It is important to note that you may only enable Employee Access through the Year-Ends Forms portal if the corresponding Employee Access setting in GreenshadesOnline.com is also enabled. Clicking the ‘Full employee access settings can be managed on the Access Settings page.’ link will navigate you to the GreenshadesOnline.com setting.

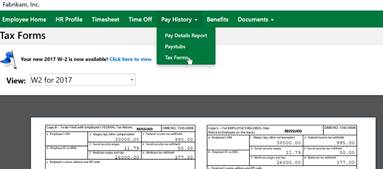

Once Employee Access is enabled, those employees that have pre-consented or consented to receive their tax form(s) electronically will be able to view their tax form through GreenEmployee.com à Pay History à Tax Forms.

2.2.2.2

Turbo

Tax Setup

Only

available for W-2 formsets

If you would like, Greenshades will synchronize your employee year-end forms data to Turbo Tax. If you choose to synchronize your forms, your employees will then be able to download their W-2 data directly from Turbo Tax while completing their 1040. After beginning synchronization, any changes you make to your forms will automatically synchronize to Turbo Tax.

Please note that the synchronization cannot be turned off once it has been activated; please make sure your forms are ready to be viewed within Turbo Tax before you activate synchronization.

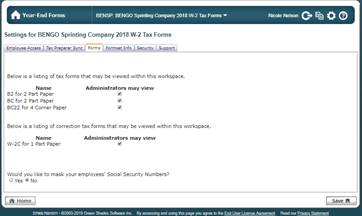

2.2.2.3

Forms

The Forms settings allows the administrator to choose which form templates should be made available for administrators to view and create distribution batches with and for recipients to view, if applicable. Some form types offer multiple template options, while others have only one template.

All templates will be defaulted to checked on. Review these settings on import to ensure the templates you prefer are selected.

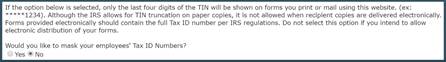

Additionally, other form types in

which the IRS allows the truncation/masking of an

employee’s/recipient’s/covered individual’s SSN/TIN will have an additional

setting on the Forms settings. If ‘Yes’ is selected, all SSNs/TINs will be

applied a mask of *****1234, which will appear on any generated PDFs of the

employee/recipient’s tax form, as well as when it is displayed electronically

or included in a mail service batch.

2.2.2.4

Formset

Info

Formset Info provides the administrator with details pertaining to the selected formset. It is important to review when this formset is due to expire, as archive fees apply to retain formsets beyond 12 months from import.

This page provides a link to create a Download Batch or Request a CD as an alternative archiving method to store your forms locally.

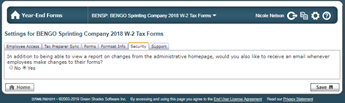

2.2.2.5

Security

Only available for W-2, 1095-C, and T4 formsets

For formset types (W-2s, 1095-Cs, and T4s) that allow employee access, an additional setting allows the administrator(s) on the formset to receive an email notification when an employee makes an edit to their electronic tax form.

Further details on allowing additional employee edit options is discussed in Section 3.1.5.3.

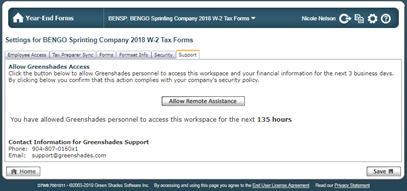

2.2.2.6

Support

While troubleshooting an issue or question with Greenshades Support, you may be asked to Allow Greenshades Assistance from with the formset settings. This will allow our support and product teams access to your formset and data for a 3-business day period to help resolve the issue.

For additional support please contact us.

(888) 255-3815 ext.1